|

Linprop newsletter October 2012

Can you believe that it is October already? Time flies!We are quite busy - buyers who want to relocate at the end of the year are now urgently looking to buy. Keep that in mind if you plan to sell in the near future.

This month's newsletter offers some information on a possible tax saving if your property is owned by a legal entity, and we share some thoughts on subject-to sales. We also have Plascon's colour forecast for next year, if you consider repainting and are looking for some colour inspiration.

If you have a home office, there are some rules to adhere to - read more about that. Lastly we introduce the Linden Community Association.

Until next month!

Kind regards

Daleen and Carina van der Linde

The Linprop team

Act now, or forever lose thy tax break!

The background is that SARS wants to lower its administration workload by reducing the number of corporate entities and trusts so it can focus more on taxpayer compliance. As a result, SARS is incentivising you to transfer your residence to a (qualifying) individual now, by allowing you to do so free of transfer duty and dividends tax, and with the Capital Gains Tax (CGT) “rolled over” i.e. not payable until the new individual owner eventually sells the house down the line.

Why bother? Major tax savings

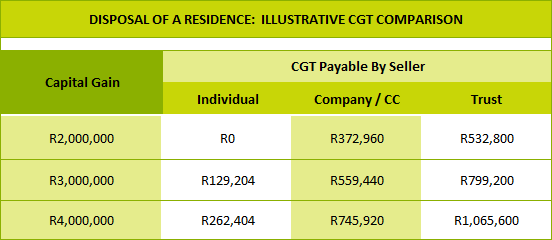

When you eventually sell the residence, you will pay CGT on any “Capital Gain”, and the benefit of this tax break lies in the fact that you are likely to pay a lot less CGT if the property is in an individual’s name than if you keep it in your corporate or trust. The CGT savings flow largely from the fact that only individuals stand to benefit from the “primary residence exclusion” of R2m and the “annual exclusion” of R30,000.

Another potential tax benefit is the saving of a further 15% in dividend tax (not shown in the figures below) which will be payable if your corporate sells the property and then distributes the proceeds.

Have a look at the following table to see just how much CGT you could save by taking advantage of this opportunity.

N.B. The figures shown below should not be taken at face value; they are only a rough guide to illustrate the potential tax savings. Take proper advice on your particular circumstances!

(Note: If the table above does not display correctly, please see the online version)

NOTES TO TABLE

• Dividend tax of 15% applies when companies and CCs distribute the proceeds. So if you want to take your profit out of the corporate, you will pay another 15% dividend tax over and above the CGT.

• A “special trust” (i.e. a trust created solely for the benefit of a person who suffers from a mental illness or a person who suffers from any serious physical disability) is treated as an individual in this instance.

• Holiday homes - although the “primary exclusion” of R2m applies only to a “primary residence” and not to a secondary residence such as a holiday home, the tax savings will still be significant.

• On death, the “annual exclusion” increases to R300,000 for the year of death.

• All exclusions are shown at the new, increased rates likely to come into effect shortly.

• CGT for individuals is shown at the maximum marginal rate so it will be a lot less for anyone with a low marginal rate.

• With a trust, you may be able to reduce the CGT substantially by having the proceeds taxed in the hands of a beneficiary with a low tax burden.

The window of opportunity is closing…..

You will lose out on these tax savings if you fail to act before the 31 December 2012 deadline.

Don’t delay – this is a complex issue with many grey areas, and you need to take proper advice NOW on these three questions –

1. Do you qualify for the relief?

2. If you do qualify, will it benefit you in your particular circumstances?

3. How should the disposal be structured to give you the maximum benefit?

FAQs

• Do I qualify? Not everyone will qualify, but consult your attorney to check. If your property is mainly used for residential domestic purposes, you are off to a good start.

• Does my holiday house or secondary residence qualify? Yes, the benefit has been extended to houses other than your primary residence, subject to restrictions relating to domestic, rather than business, usage. Remember that the “primary exclusion” of R2m won’t apply here.

• What about my company/trust structure? If you have a “multi-tier” structure (e.g. your company owns the house, and another company or your trust owns the shares in the company) the benefit has also been extended to you. Again, this is subject to restrictions and requirements, so taking advice is essential.

• Even if I qualify, will I benefit? Take full advice on this one – depending on your particular circumstances, there may be good reason to leave the property where it is. Consult a professional on considerations such as estate planning, asset protection, conduiting a trust’s distributions to a beneficiary with a low tax burden, etc.

• Are there any risks? The disposal must be carefully structured by a professional to avoid any triggering of donations tax, dividends tax, adverse tax effects of any loan accounts etc. If the property is bonded, remember to give the bank timeous notice of cancellation, and also check that the transferee will qualify for a new bond (and if so, at what interest rate).

• To whom should I transfer the property, how should I dispose of it, and at what price? Once again, take advice here - everyone’s circumstances will be different, and there are many considerations.

• When must I dispose of it by? 31 December 2012.

• What will it cost me? The good news is that there is no transfer duty payable, and CGT is “rolled over” i.e. not payable now. Provide for conveyancer’s fees, bond cancellation and registration fees, the cost to deregister or liquidate entities etc.

• Once I have moved my residence into my name, how long do I have before de-registering or liquidating the entity that owned the residence? SARS gives you six months to begin these proceedings and will probably give an extension if you ask. If there are other assets in these entities, SARS have made concessions to help you – speak to a professional.

Take advice, and take it now!

This is serious stuff, with the potential for huge savings, but also the potential for significant losses if incorrectly handled. The complexities make it essential to get started now!

Subject-to sales

The ideal situation is certainly that the buyer of a property does not have to sell a property in order to buy a property, or that he has already sold his property and that all suspensive conditions relating to that sale have been met. From the buyer’s perspective, it means that he is in a strong position to negotiate the price and conditions of the sale; from the seller’s perspective, it means certainty that transfer is likely to be registered within a reasonable period.

But we do not live in an ideal word. Sometimes buyers find their dream home before they have sold their current property, and they need to sell and cancel their present bond before they will be in a position to afford the new property.

What are the implications of buying a property, subject to the sale of another property?

If the buyer’s property still has to be sold, the sales agreement will usually determine that the seller may continue to market the property until such time as the buyer accepts an offer on his (the second) property. Should the seller receive a further offer on the property which he would like to accept, the sales agreement would usually make provision for a copy of the “new” offer to be handed to the purchaser, who then has time (usually 48 hours, but this period is stipulated in the sales agreement) to waive the suspensive condition of selling his (the second) property . In other words, the purchaser then undertakes to buy the property without selling his property. If the purchaser cannot do that, the sales agreement lapses and the seller is free to accept the second offer. If the purchaser waives the suspensive condition of selling his property, it means that he has to come up with the money in another way and that guarantees are due within a specific period.

Should a purchaser waive the suspensive condition and he is then not able to deliver guarantees for the purchase price at the time stipulated, he will be in breach, and the seller may cancel the sales agreement after a notice period as stipulated in the agreement. Furthermore, the seller may retain any deposit as “rouwkoop” and may also claim damages from the purchaser. For this reason, a purchaser who made an offer on a property subject to the sale of a property, should only waive this suspensive condition if he is 100% certain that he will be able to deliver guarantees when required.

Often a buyer’s property has already been sold, and is in the process of being transferred. These buyers often regard themselves as cash buyers, as they will be able to purchase the property with the proceeds of the sale of the second property. Be careful. A buyer is only a cash buyer when he already has the money in the bank. If the transfer process is still under way, it is wise to link the purchase of the property to the sale of the second property. If the sales are linked and anything then goes wrong with the transfer of the second property, the purchaser does not have to come up with money that he does not yet have.

What can go wrong, you may ask. At worse, the purchaser of the second property may die and the sale may be either cancelled or become part of an estate. The purchaser of the second property may also default by for instance not signing documents for paying transfer costs, which could cause delays. If the sale of the two properties is not linked, a nonperforming purchaser of the second property will not allow the purchaser to withdraw from the sales agreement. He will be in breach if he does not deliver guarantees timeously, and the seller will be able to claim damages from him – even when the problem is caused by the purchaser of the second property.

If it is this tricky, why would sellers consider an offer which is subject to the sale of another property?

Firstly, it may be a good offer financially. If a seller has two offers, of which one is a “clean’ offer (not subject to the sale of a property) and the other an offer subject to the sale of a property, but also much higher, the seller may decide to accept the higher offer – especially if he has time to wait for the sale of the second property and does not need a speedy transfer.

Secondly, it may be clear to the seller that the purchaser is likely to sell his property at his required price within a reasonable period. A good agent will be able to advise a seller on the likelihood of this.

Thirdly, until such time as the purchaser sells the second property, the seller is entitled to continue marketing his property and he may accept such further offer if the purchaser cannot waive the suspensive condition of the sale of his property. The time period allowed for this waiver is quite short, and the seller is unlikely to lose an interested buyer which makes a good offer because of the offer already on the table.

It is important to note that the terms of the sales agreement - such as price and occupation date - remain unchanged. If a seller has accepted an offer and gets a further, higher offer from another buyer, he cannot insist on the price of the first offer to be increased.

Be colour inspired

With descriptions like Simplicity, Contrast, Pause and Dare, the colour forecast for 2013 offers something for every single taste and emotion.

In their media release the Plascon team explains that "Each forecast aims to capture a feeling of what’s happening in society, looking to reflect people’s needs and desires. But with the rapidly moving and changing environment we live in, it is often hard to express these feelings when faced with the continuous discord and flurry of imagery.

In times of uncertainty like this we crave stability and balance in our lives and for that very reason the theme for the Plascon 2013 Colour Forecast is ‘balance’.

It explores how we use colour to bring harmony when everything around us is constantly changing. Whether it is the calm we find in whites and soft pastel colours, or the energy we seek in bright daring colours, we can always find balance in colour.

As the name suggests, Simplicity is about stepping out of the chaos and into the calm. This palette is inspired by light white tones, which appeal to our desire for peace and serenity. Also included in this theme are metallics, which add a bit of sparkle and optimism and green, which brings a sense of nature.

The theme of Contrast aims to build a centred atmosphere within your home by using deep blues and greys together to create a contemplative and grounded feeling. This is given a sense of energy with high contrast brights like fuscia pink and bright yellow. The combination may be unexpected, but extremes of colour balance each other perfectly.

Pause asks you to stop and think, not just about the past, but about the now and what is happening around you and what you need. This collection of colours is light and feminine, but still connected and mature. The overall effect hints at nostalgia, while retaining a very welcome sense of the contemporary.

Lastly, Dare is perhaps the most vibrant theme of them all, but without being overwhelming and outrageous. The overall feeling of this palette is energetic without being manic. Often when times are hard we crave bright optimistic colours to lift our spirits and keep us motivated."

View the Plascon Colour Forecast 2013 to see the exciting range of colours for next year.

* Photos and press release with compliments from Plascon.

Working from home

The rules of home offices are set out in the Town Planning Scheme of each municipality. In greater Johannesburg, the rules set out in the Town Planning schemes of Johannesburg, Sandton and Randburg still apply in the areas which previously fell under these municipalities.

In areas which previous resorted under the Johannesburg municipality, having an office at home is allowed subject to the following provisos:

• No more than 20% of the floor area of the house and outbuildings may be used for this purpose.

• Any alterations necessary - internal and external - must be residential in character and to the satisfaction of the Council.

• No more than two additional persons to be employed to work in the business.

• Residential property may not be used as a shop, public garage, industrial building or for a noxious industry.

• No sign may be put up other than a sign normally put up to indicate the name and profession or occupation of the occupier. Note that there are also rules with regards to the size of the signage.

• The use of the property may not interfere with the amenities of the neighbourhood or cause an undue increase in traffic in the neighbourhood.

• Nothing may be stored or kept on the site which, in the opinion of the Council, is unsightly or undesirable.

If one wants to use more than 20% of the premises as an office, or wants to employ more than 2 people, consent to do so may be applied for at the Council. Residential use must however remain the predominant use.

The rules of the Town planning schemes of Randburg and Sandton are very similar, but should be studied if your property is situated in those areas.

Should you have any queries with regards to home offices, contact Eduard van der Linde on 082 610 0442 or eduard@thetownplanner.co.za.

The Linden Community Association (LCA)

The LCA was formalised on 25 January 2012 at a Public Meeting at Hoërskool Linden.

It is mainly comprised of a few Linden residents who are all volunteers and who believe in working together and effectively with all residents, business owners and the likes; towards a safe and secure suburb which we can all call “home”.

Our main aim as the LCA is to:

First and foremost COMMUNICATE – EDUCATE and ESCALATE.

We believe that a suburb that knows what’s going on, where everyone contributes in their own small way; is aware of their surroundings and knows their neighbours will exceed their own expectations!

The LCA aims:

• to be united in our fight against crime and to implement high-level measures in this regard

• to communicate with the residents; to enhance a sense of ‘community’, making sure each resident knows they are not ‘alone’ in the suburb

• to educate the residents regarding which contact numbers / municipal or government departments to call in what situations (i.e. SAPS vs. JMPD, City Power etc.) and to urge all residents to obtain reference numbers for all their reports; this is vital

• to monitor issues affecting the suburb generally and to escalate these issues on behalf of the community through a strong, united voice

• The LCA has implemented successful Proactive Security Solutions with the Linden SAPS in the form of Sector Policing, LNW, ADT and CSS Tactical

The LCA is not the Alpha and Omega of Linden; small groups of residents have been active for years but we firmly believed we needed some form of communication and unity in the suburb.

For further information please log on to our website at www.lindenjhb.co.za and send us your details, name, street address so that we can put you on our database to receive our weekly newsletters at lindenjhb@gmail.com.

We look forward to hearing from you.

Leisl-Mae Fourie

LCA and Sector 2 Chairperson

After the National crime states were recently released each Precinct has to go to the communities in each sector and break down how the crime stats have played a role and contributed in that specific sector.

Linden SAPS invites ALL Sector 2 Residents to please join us in conjunction with the Sector 2 Sub Forum for this debriefing on:

7th November

18h30

Linden SAPS Hall

<< News

|

|