|

Linprop news

Spring is around the corner, but apparently we shall still have to brave one or two cold spells before we can unpack our summer clothes. Officially spring starts on 1 September, and we suggest a few spring garden resolutions in our first article.

Spring is also the time of year when one often considers some redecorating. A new wall colour is a very economical way to brighten up a room. We share Plascon's recently launched colour forecast for 2014, which may inspire you to take up those piant brushes.

The City of Johannesburg made some positive adjustments to the pensioner rates rebates - do take advantage if you meet the criteria, and spread the word too!

The Consumer Protection Act has been with us since April 2011. Amongst many other things, it also has implications for landlords and tenants. It is important to know what these implications are. The article on the CPA sheds some light on this.

Lastly: we love referrals! If you know of someone whom we can help in selling or renting a property, or in finding their dream home to buy or rent, please send us their contact details? We promise to take good care of them.

Kind regards

The LINPROP TEAM

Daleen van der Linde

082 600 7894

Carina van der Linde

082 603 8694

Spring gardening resolutions

- Resolve to enjoy your garden. Gardening is about creating beauty and enjoying the process, as well as the result. Spend time attending to chores, but also take time just to enjoy the beauty, sun, birdlife and fragrances lingering in the air. Time spent weeding and watering can be really good thinking times!

- With a notebook at hand, take stock of the garden. There is always room for improvement. Set goals – by when do you want to create that little reading corner, build the braai or water feature, or have a thick carpet of green lawn? Then plan how you are going to achieve this goal. A garden notebook in which this is jotted down makes great reading matter a few years down the line.

- Resolve to spend a little time in the garden on a regular basis. You have heard this one: How do you eat salami? One slice at a time. Half an hour spent daily to weed, deadhead or water will make a huge difference. It is much easier to spend a few minutes each day pulling weeds, than it is to do it once a week.

- If you have a compost heap, use the compost to enrich the soil – good soil is the number one key to a healthy garden. If you are not making your own compost as yet, get going - there are some great tips on this in an article we published before: Making your own compost.

- Resolve to mulch regularly. This protective layer of organic stuff like wooden chips or straw moderates the soil temperature, conserves water, inhibits weeds and provides an attractive ground cover in your flowerbeds or vegetable garden.

- Resolve to concentrate on indigenous plants when you plant. Indigenous plants adapt much easier to periods of stressful weather, such as droughts. They also help sustain beneficial insect and bird populations because they attract native pollinators and birds.

- Add one new sustainable method to your gardening routine. Working in harmony with nature instead of fighting it, will improve the health of your soil, the bounty from your garden and minimize negative effects on the environment — as well as cut down on your stress levels! There are many sustainable practices you can use to increase your gardening enjoyment. One example would be to eliminate chemical fertilizers. Another would be to install one or more rain barrels to capture rain run- off from the roof.

One new good gardening habit may make a huge difference!

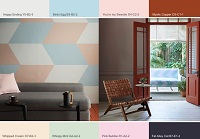

Colours inspired by our colourful nation

With descriptions like Urban Tribe, Second Nature, Calm Contrast, and Inner Space, the colour forecast for 2014 offers something for everyone, every individual, every cultural group, and the entire nation.

In their media release the Plascon team explains that "Plascon’s Colour Forecasts are a blend of the latest trends both locally and internationally. Each colour plays a vital role in translating the trends that we see in a multitude of industries."

For the 2014 forecast, Plascon's Colour Manager, Anne Roselt, worked in conjunction with leading design and trend thinkers, who identified key lifestyle, design and interior trends and then crystallised these into four key themes. These all fall under the overall theme for 2014 of Colour Nation – referring to the ways in which colour defines our identities, our world, and our experience of it.

Urban Tribe is a response to the growing trend towards national pride – especially amongst BRICS nations. With countries like South Africa and Brazil coming to the fore as global centres of design, their unique aesthetics are being showcased around the world. Urban Tribe expresses this with a warm and grounded palette of contemporary brights, plus gold and black accents.

Second Nature takes a new look at our relationship with the natural world. As more and more people live in cities, the urban becomes our key reference point, and combining this with the natural world becomes vital to keep our lives balanced. This sentiment is captured in a bright, vibrant palette of greens and blues, activated by a bright yellow accent.

Calm Contrast tracks the evolution of pastels in modern design, showing how they’ve moved from on from being purely “feminine” colours. This palette shows the combination of classic pastels with grounding neutrals, plus dark blue and copper, creating a balanced, contemporary feeling.

Inner Space is inspired by the ways in which we use sanctuary environments to rest and reflect in a busy world. Drawing additional colour inspiration from the stars and skies above us to enhance the contemplative mood, the theme is expressed through a collection of neutrals and blues for a deep, tonal palette.

View the Plascon Colour Forecast 2014 to see the exciting range of colours for next year.

* Photos and press release with compliments from Plascon.

Pensioner rates rebates - some good news!

Note that rebates are not granted automatically. It has to be applied for.

As of 1 July 2013, the following people will be able to qualify for rates rebates:

-

If you are between 60 and 70 years old, your property is valued at less than R2 000 000, and your monthly income does not exceed R7000, you qualify for a 100% rebate;

-

If you are between 60 and 70 years old, your property is valued at less than R2 000 000, and your monthly income is between R7000 and R12000, you qualify for a 50% rebate;

-

If you are over 70 years old and your property is valued at less than R2 000 000, you qualify for a 100% rebate regardless of your monthly income.

The application forms can be obtained at any municipal Customer Service Centre. The application form for rebates for pensioners younger than 70 is available on the City of Johannesburg’s website (click here), but the application form for pensioners older than 70 is not. Email me at daleen@linprop.co.za and I shall send you the form.

Pensioners between 60 and 70 need to submit the application form together with the following documentation:

-

Your identity document;

- Proof of income for the previous tax year (SARS assessment); and

-

Proof of current income.

The criteria for this category are:

-

You are the owner of the property in respect of which the rates are charged;

-

You live on the property;

-

You must be at least 60 years old;

-

The municipal value of the property as at 1st July, 2013 must not exceed R2 million. The value of the property will be reflected on the rates account of the City of Johannesburg for the month of July, 2013 and subsequent months.

Pensioners older than 70 must submit the relevant form together with a copy of an identity document.

The criteria for this category are:

- There is no income threshold. Earnings are not taken into account.

- The municipal value of the property as at 1st July, 2013 must not exceed R2 million. The value of the property will be reflected on the rates account of the City of Johannesburg for the month of July, 2013 and subsequent months.

- The applicant for the rebate must be the owner of the property. If the property is in joint ownership, at least one of the owners must be over the age of 70.

- The applicant must live on the property.

Councillor John Mendelsohn suggests that the application be submitted as follows:

-

Complete the application form and have it signed by a commissioner of oaths (attorney, police officer, bank manager, councillor).

-

Make a duplicate copy of the form to keep.

-

Take the form together with an ID document to the nearest City of Johannesburg walk-in Customer Centre. The closest ones are in Randburg (corner Braam Fischer and Jan Smuts) or Sandton (corner Fredman and 5th) or Braamfontein (161 Jorrissen St).

-

Request the Customer Consultant to sign a receipt for the original on the duplicate copy, date it and stamp it with the official rubber stamp. Request the consultant to print his or her name in capital letters next to his or her signature. Keep the duplicate in a safe place.

- The Customer Consultant must accept the form, scan it and dispatch a Service Request to the Rates Department, and place the form in a “Rebate Application” box for collection by/delivery to the Rates Department.

At least one billing cycle will lapse before the application is processed. This means that an application submitted in September, 2013, will not reflect on the rates account until November 2013. The rebate will not be backdated. It will take effect from the time of processing.

CPA: As much of a swear word as FICA and RICA?

The purpose of the Consumer Protection Act (CPA) as defined by the Act itself is: “To promote a fair, accessible and sustainable marketplace for consumer products and services and for that purpose to establish national norms and standards relating to consumer protection, to provide for improved standards of consumer information, to prohibit certain unfair marketing and business practices, to promote responsible consumer behaviour, to promote a consistent legislative and enforcement framework relating to consumer transactions and agreements…”

The section of the Act that influences lease agreements specifically is section 14, which deals with the expiry and renewal of fixed term agreements. The CPA is not of relevance when the tenant is a juristic person, which includes a Body Corporate, a partnership, association, or a trust, nor is it of relevance when two juristic parties go into a lease agreement.

The first limitation the CPA puts on lease agreements is that an agreement may not exceed a period of 24 months, unless there is a financial benefit for the tenant if the agreement is for longer than 24 months.

The CPA also allows a tenant to give a landlord 20 business days’ written notice at any time during the agreement to cancel the agreement. The Landlord may also cancel the agreement if the tenant is in breach of the agreement, and has received 20 business days’ written notice to rectify the breach and fails to do so.

If the tenant or the landlord cancels the agreement with 20 business days’ notice as prescribed above:

- The tenant remains responsible for any amounts that are still owed in terms of the lease agreement up to date of cancellation of the agreement;

- The landlord may impose a reasonable cancellation penalty on the tenant for early cancellation of the agreement;

- The landlord has to credit the tenant any amounts that belong to the tenant after the date of cancellation of the agreement.

The CPA does not prescribe what is considered to be a reasonable cancellation penalty, but does give a few guidelines to determine this figure:

- The amount that the tenant would have paid the landlord if the lease agreement was not cancelled before the expiry of the agreement;

- The value of the lease agreement up to date of cancellation of the agreement;

- The initial period of the lease agreement;

- The length of notice that was given;

- The potential for the landlord to find another tenant if he acts diligently to find a replacement tenant;

- The industry norm.

It is however easier to agree in the lease agreement what the penalty will be for early cancellation of the agreement, to avoid any uncertainty.

It is also necessary for a landlord to inform his tenant in writing between 80 and 40 business days before the expiry of the lease agreement that the lease is expiring. In this notification, the landlord should inform the tenant of any material changes that will come into effect when the lease agreement is extended for a further period. This includes:

- The new lease period;

- The new rental amount payable;

- Any other changes that will affect the tenant’s use of the premises.

If the tenant does not explicitly renew the agreement with the landlord, the agreement will continue on a month to month basis, unless the tenant informs the landlord that he does not wish to renew the agreement.

In the end, it can only be beneficial for a landlord to adhere to the legislation and follow the rules.

<< News

|

|